It sounds like you're talking from another world when you hear reports that economic data are improving and that the economy is unwinding. My quality of life hasn't improved at all, and it's getting more difficult, but what's better? This is because it does not reflect the actual economy and reports only nominal figures. Based on the KDI report, we conducted an economic analysis in 2023, so please refer to it and respond in advance. I'm sure it will help you.

Go to 2023 Financial Services Commission policy direction

2023 Economic Analysis

The Korean economy is expected to record a low growth rate of 1.8% in 2023 as export growth slows significantly and investment slump continues. Private consumption, facility investment, construction investment, and exports are all expected to slow down. It is expected that the global economic growth rate will be 2.7%, the unit price of crude oil (based on Dubai oil) will be around $84, and the value of the won (real effective exchange rate) will be devalued by about 4%. A devaluation means that the value of the won will decrease. It is usually said that the exchange rate rises normally.

Go to the latest economic trends in 2023

Domestic economy and export

▶ Domestic economy

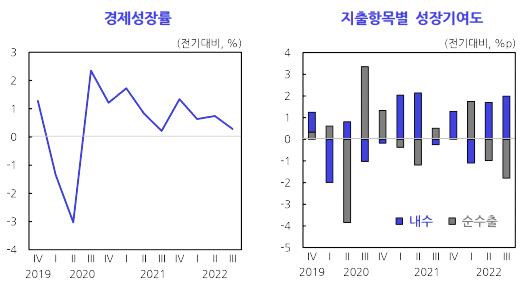

Recently , despite the improvement in domestic demand, the growth of the Korean economy has been weakening due to sluggish exports due to deteriorating external conditions . Seasonally adjusted gross domestic product (GDP) in the third quarter increased only 0.3% compared to the previous quarter as the contribution of net exports to growth declined.

As the terms of trade (export prices relative to import prices) deteriorated, gross domestic income (GNI), a measure of real purchasing power, actually declined despite economic growth.

Note) The terms of trade for the third quarter of 2022 were calculated using real trade losses.

As for domestic demand, the private consumer maintained a high growth rate, the sluggish investment was partially alleviated , and the job market is also maintaining a good shape , centering on the service industry . Private consumption has recovered mainly in the face-to-face service industry, and the sluggishness in investment has temporarily eased.

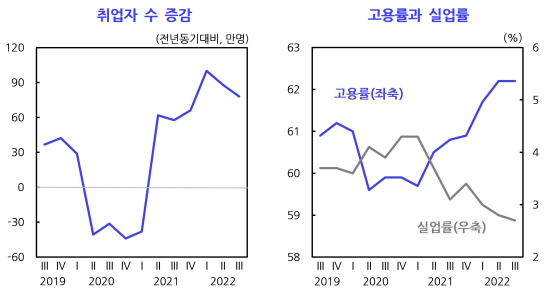

While the number of employed people has increased significantly, the employment rate remains at a high level and the unemployment rate remains low, indicating a favorable job market.

Note) Employment and unemployment rates are based on seasonality.

▶ EXPERT

On the other hand, exports are sluggish due to the global economic slowdown, and external conditions are highly likely to deteriorate in the future . While exports decreased mainly in semiconductors, the current account turned into a deficit.

(Source: Korea International Trade Association, Bank of Korea, KDI)

Note) The fourth quarter of 2022 is the figure for October, and the current account is based on a seasonally adjusted basis.

world economy

The global economy is showing signs of entering a phase of economic slowdown due to the sharp rise in interest rates in the US while raw material prices remain high . Steep interest rate hikes in the US and a strong dollar are constraining the recovery of global trade, and other countries are also raising interest rates rapidly to counter inflationary pressures.

As the crisis in Ukraine is prolonged, high inflation continues in most countries, especially in Europe, and the Chinese economy continues to suffer from economic sluggishness while maintaining a zero-corona policy. are doing As a result, the economic teacher index declined and corporate sentiment deteriorated, implying a slowdown in the global economy.

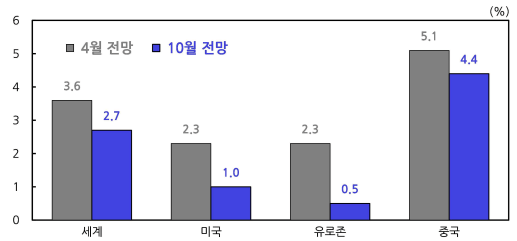

Major international organizations predict that the global economy will slow down in 2023, centering on the eurozone. Recently, the IMF lowered the global economic growth rate in 2023 to 2.7%, which is significantly lower than the past average (2011-19: 3.5%). We assessed the possibility of falling short of this forecast as high.

<IMF's projections on the economic growth rate of major countries in 2023>

Consumer prices and private debt

▶ Consumer prices

Consumer prices continue to rise at a high level, and expected inflation is also rising . As the supply shock prolongs and spreads throughout the economy, the upward trend in core inflation is also expanding.

Note) Core inflation refers to consumer prices excluding food and energy, and the fourth quarter of 2022 is the figure for October. .

▶ Private debt

In a situation where private debt is high, market interest rates are rising, limiting the recovery of domestic demand. Since the fourth quarter of 2021, household debt has been suppressed while corporate debt continues to expand, and the financial market, centered on the corporate bond market, is temporarily unstable.

Note) Private debt is based on cash flow statistics, and interest rates on household loans are based on new loans.

Domestic and foreign economic conditions

Taking a comprehensive look at internal and external economic conditions, the Korean economy is expected to enter a phase of economic slowdown due to sluggish exports and investment. Due to interest rate hikes in major countries in response to high inflation and the resulting global economic slowdown, exports are expected to intensify sluggishness. It is expected to alleviate.

Major economies such as the US, China, and the Eurozone are expected to be sluggish, and downside risks to the global economy are assessed to be high.

<Private Consumption and Export Growth Rate Forecast>

(Source: Bank of Korea, KDI)

In 2023, the Korean economy is expected to remain in the phase of economic slowdown due to the global economic downturn and rising market interest rates. Growth is expected to slow down significantly in the first half of 2023 as the impact of domestic and foreign base rate hikes gradually ripples through. Inflation pressure may be reduced due to the economic slowdown, but consumer price inflation is expected to meet the inflation target (2%) in 2023 as well.

In the short term, it is necessary to continue efforts to strengthen financial soundness while operating macroeconomic policies austerely in view of high inflation . As the high inflation trend continues for a long time, it is necessary to gradually raise the base rate and control the increase in fiscal expenditure so that expected inflation does not deviate from the level of the inflation target.

However, given the expected economic slowdown, it is necessary to adjust the pace and severity of macroeconomic policy tightening. Considering the possibility of domestic and foreign financial market instability, we need to maintain the stance of normalizing macroprudential policies.

As the growth rate of the Korean economy is weakening due to rapid population aging, policy efforts are required to alleviate the reduction in labor supply and improve productivity . The potential growth rate is expected to gradually decline as the labor supply shrinks mainly due to demographic changes and capital accumulation slows. Over the next five years (2023-27), the potential growth rate will gradually decline, and the annual average is estimated to be around 2%.

Despite high productivity, it is necessary to provide conditions for active participation in the labor market for women and the rapidly increasing elderly, who are not participating in economic activities due to the burden of childbirth and childcare, and to mitigate the decrease in labor supply by actively accepting foreign workers. At the same time, efforts to strengthen the quality of human capital through education system reform must be continued. In addition, policy efforts must be made to improve productivity through institutional reforms to strengthen the dynamism of our economy, such as external opening and rationalization of regulations.

Economic growth is ultimately achieved through productivity improvements, and the long-term growth rate of our economy will be greatly influenced by the rate of productivity growth. On the other hand, efforts to strengthen the growth potential of our economy are necessary, but pursuing a goal that greatly exceeds the potential growth rate through short-term stimulus policies should be avoided.

"He who sleeps on his rights will never be protected."

Useful video for your reference